reit dividend tax south africa

1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total. Dividends received by a South African taxpayer are generally exempt from income tax.

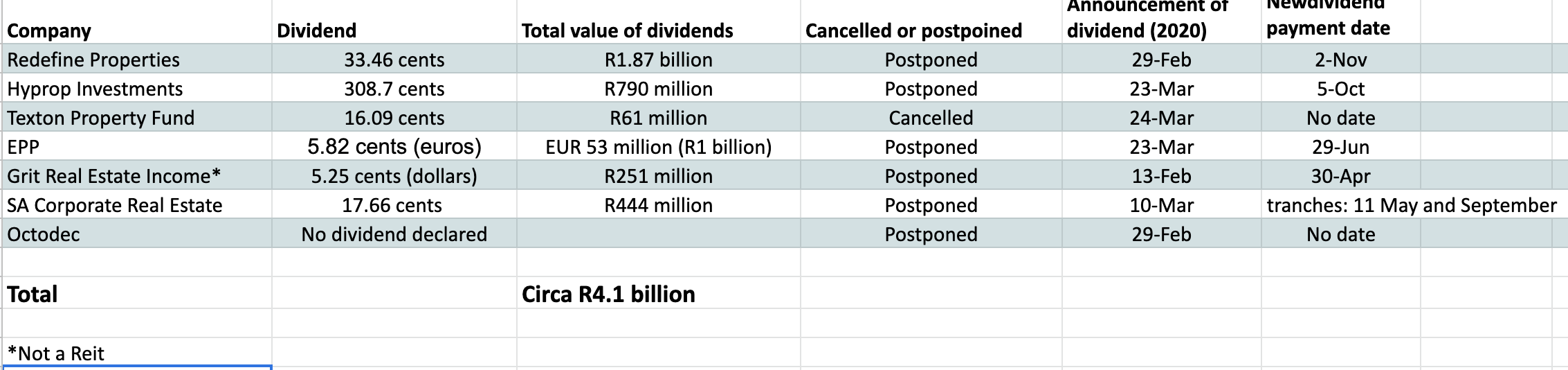

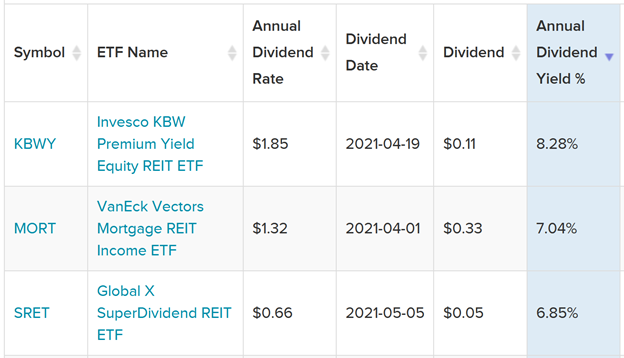

Real Estate Investors Face Dividend Drought

Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised.

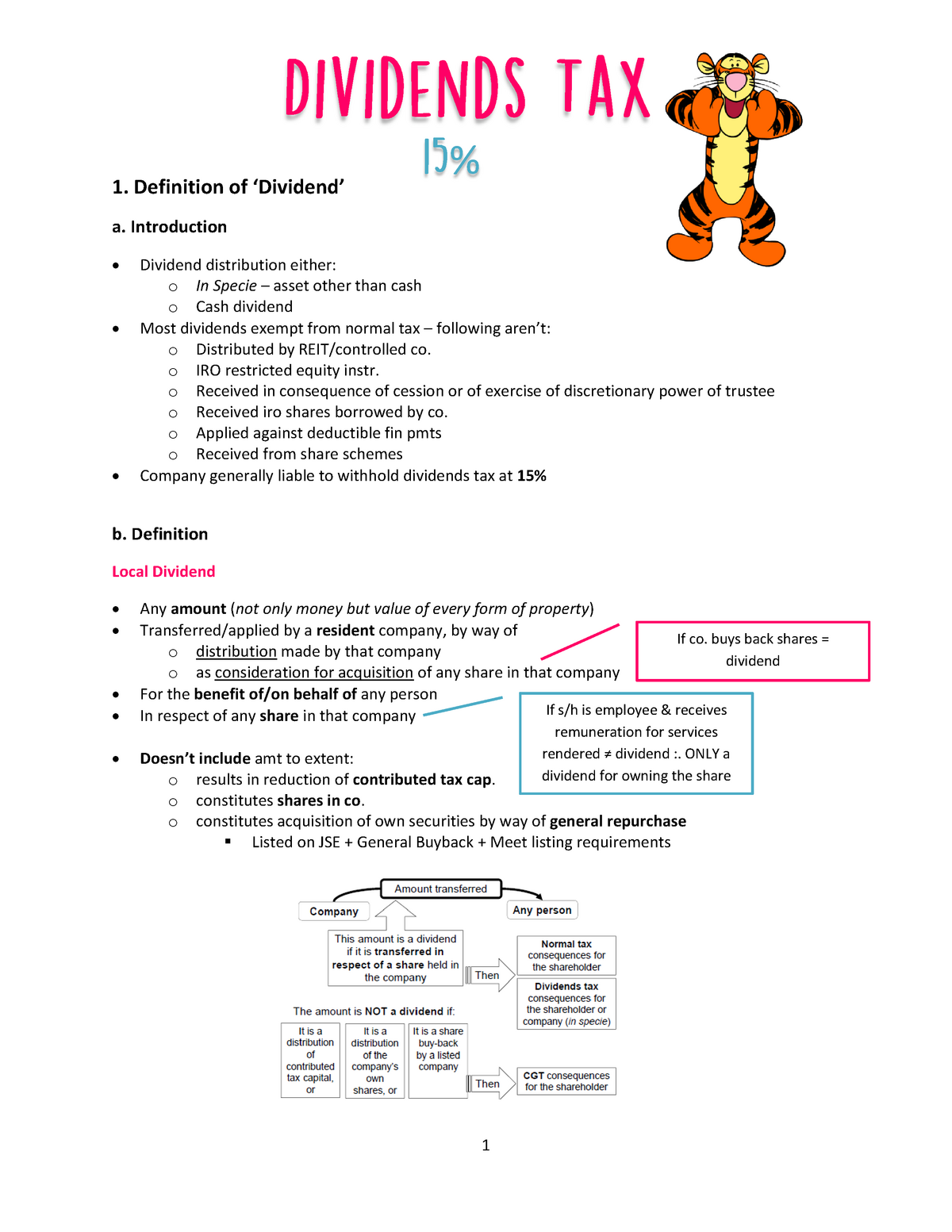

. 58 of 1962 the Act pertaining to the taxation of Real Estate Investment Trusts REITs are contained in section 25BB and were. A fundamental part of the regime. As from 1 April 2012 dividends tax is charged at 15 on shareholders when dividends are paid to them by a South African tax resident company or Foreign Company.

An understanding of the REIT structure is necessary. Shares will be deemed to be dividends for South African tax purposes in terms of section 25BB of the Income Tax Act. 23 February 2022 No changes from last year.

Top Performing REITs in South Africa. Distributions from REITs must be included in the taxpayers taxable income and will be taxed. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation.

Compliance with REIT regulations requires payment of a. Investing in SA REITs. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE Johannesburg.

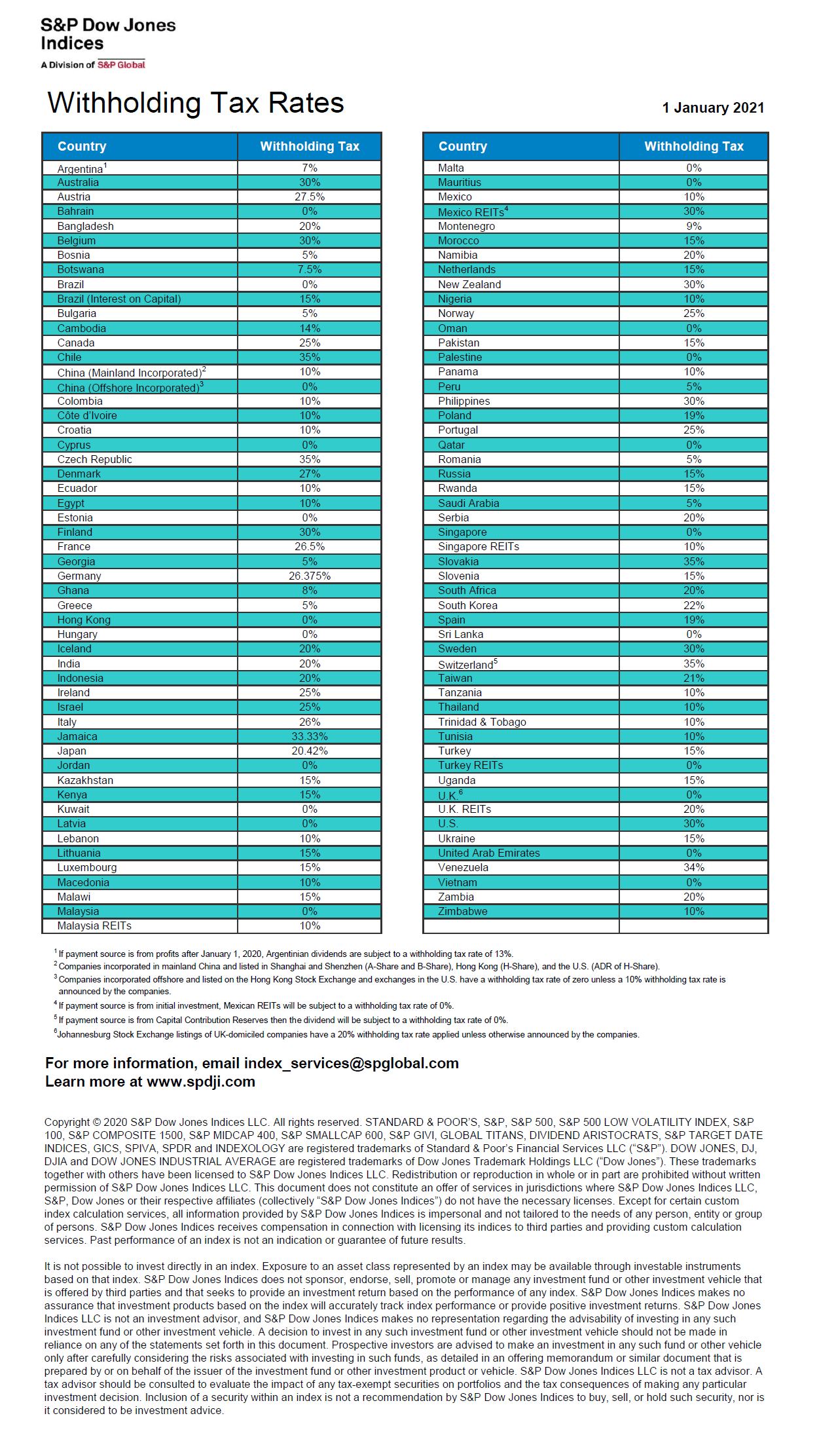

The provisions in the Income Tax Act No. Foreign shareholders of SA REITs are levied a dividend withholding post tax at. Interest distributions by a REIT or a controlled property company to a South African resident are re-characterised as taxable dividends explains Shelly Moreno head of tax.

Recharacterisation of interest distributions. The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes. The participation exemption exempts foreign dividends and capital gains from tax in South Africa provided that the South African taxpayer holds at least 10 of the total equity.

A REIT stands for Real Estate Investment Trust. Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for. Dividends received by individuals from South African companies are generally exempt from income tax but.

In South Africa a REIT. For listed property companies to maintain their REIT status they must pay a minimum of 75 of. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the.

Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation. Reit Dividends Tax. The major exemption though being dividends received from so-called REITs these being.

The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is. This is a listed property investment vehicle. Posted 2 August 2015 under Tax QA Peter says.

The property company will be more efficient in tax planning because the tax is paid in your brokerage account and not by the investor. A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets.

REIT Dividends - South African tax resident shareholders. Be subject to a 20 dividends tax which is in fact a tax on the investor. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt.

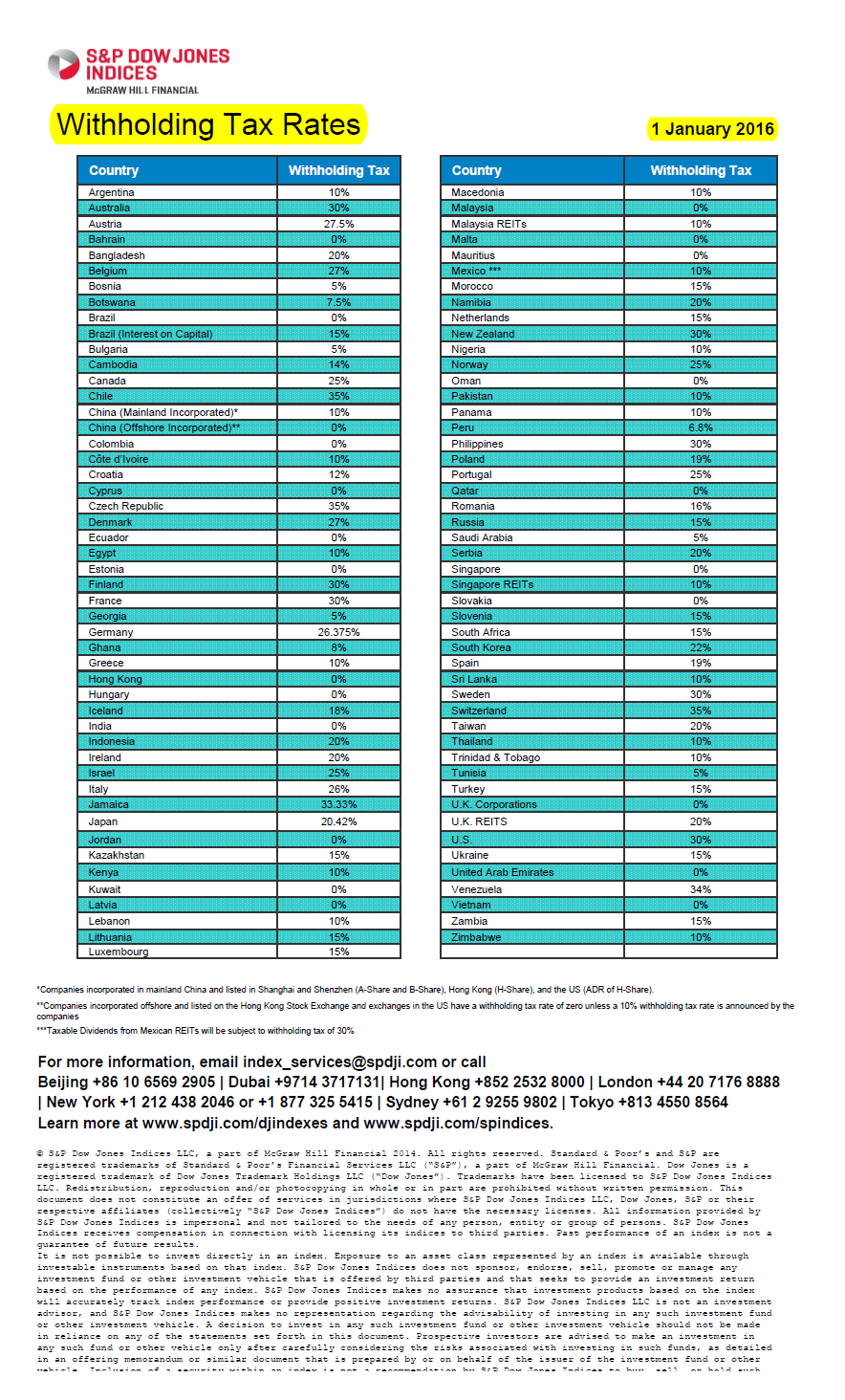

Dividend Withholding Tax Rates By Country 2016 Topforeignstocks Com

3 Reits Paying Up To 5 2 With Big Growth Potential Ahead Nasdaq

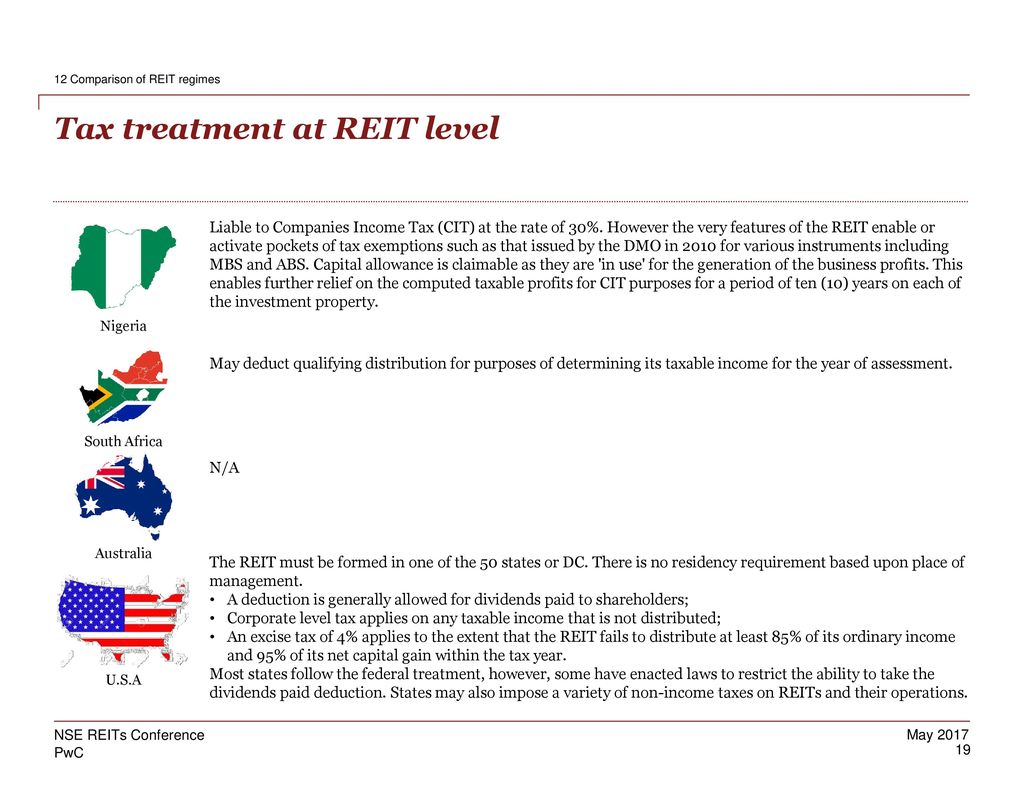

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

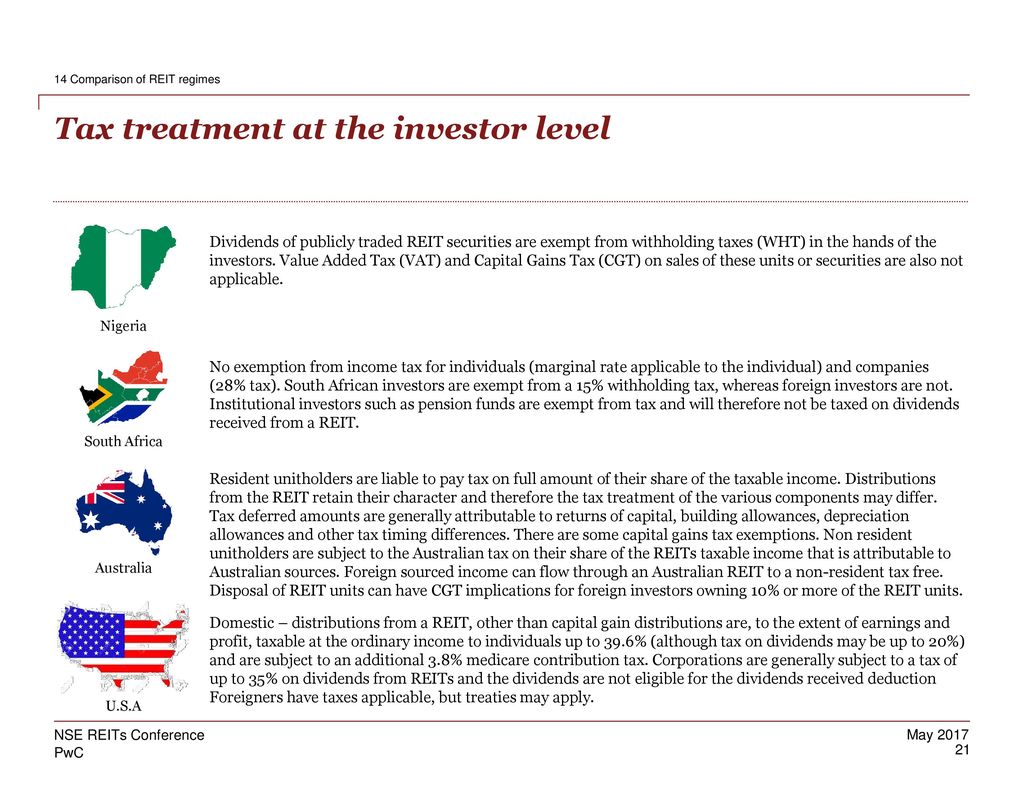

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

Dividends Tax Notes 1 Definition Of Dividend A Introduction Dividend Distribution Either O Studocu

South Africa Reits Investing Offshore International Tax Review

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Quarterly Dividends Unrestricted Model Download Table

What Is A Reit Definition Types And Investing Tips

South Africa Reits Investing Offshore International Tax Review

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Descriptive Statistics For Reits That Report Funds From Operations Download Table

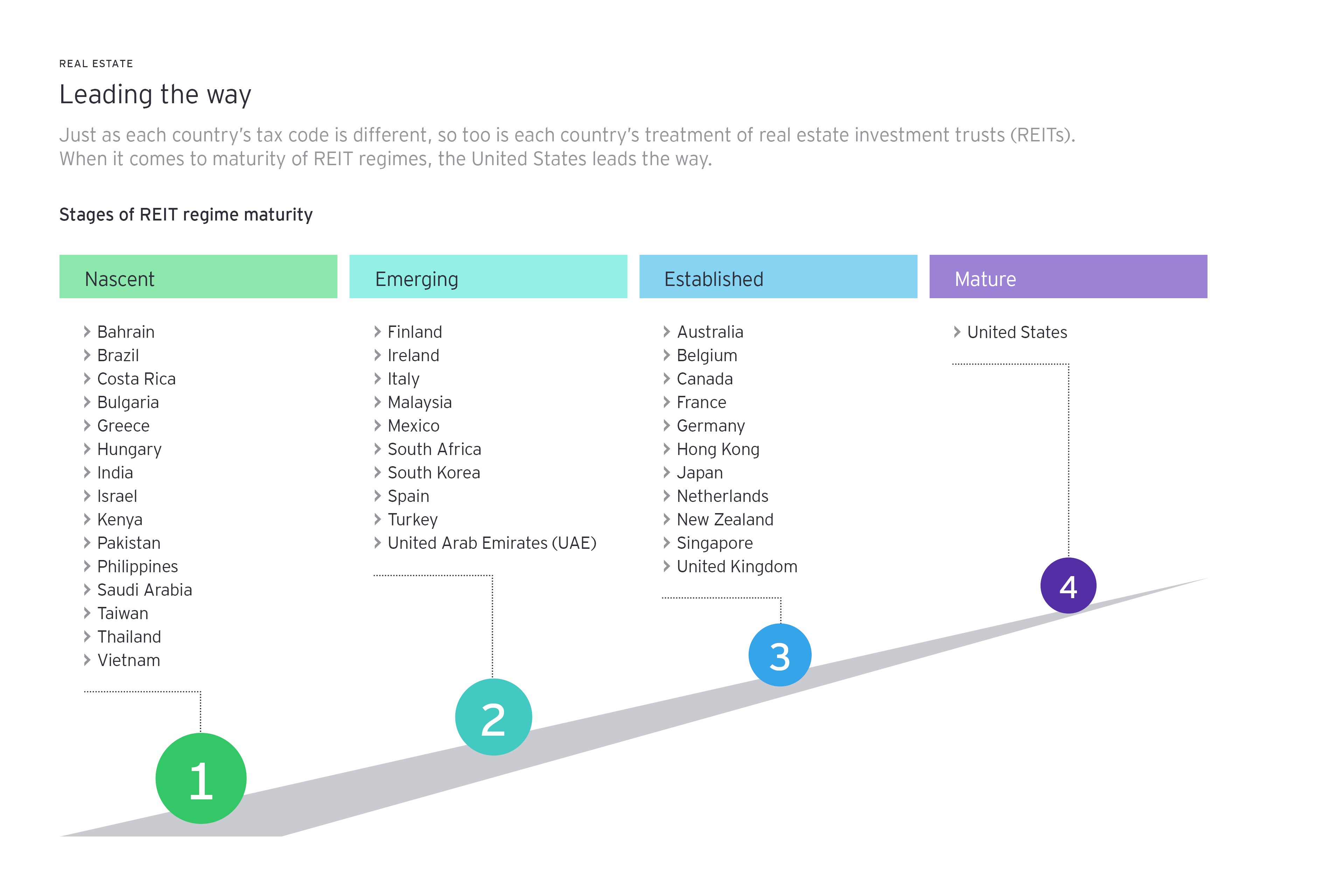

How Reit Regimes Are Doing In 2018 Ey Slovakia

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector